To promoting entrepreneurship in the country, visionary Prime Minister Narendra Modi launched PM Mudra Loan Yojana in 2015. At that time there are only three categories such as Shishu, Kishore and Tarun but now from October, 2024 Tarun Plus Mudra Loan added by the Finance Ministry.

Through rendering this article, you will get full details of Pradhan Mantri Mudra Yojana specially focused on Tarun Plus Scheme. Like eligibility criteria, how to apply online or through banks etc. Let’s dive and explore the full details.

Headings

- 1 What is Tarun Plus Mudra Loan?

- 1.1 Tarun + Mudra Loan Amount

- 1.2 Components of PM Mudra Yojana – Revised

- 1.3 Eligibility Conditions

- 1.4 Necessary documents for application

- 1.5 Tarun Plus Mudra – Interest rate

- 1.6 Tenure – Loan repayment period

- 1.7 Tarun Plus Mudra Loan 2025 Apply Online

- 1.8 Key Highlights

- 1.9 Helping benefits & Features

- 1.10 Latest Statics – Loan Sanctioned under PMMY

- 1.11 Frequently asked questions

- 1.12 Footnotes

What is Tarun Plus Mudra Loan?

Tarun Plus Mudra Loan is recently introduced by the finance ministry on 24th October, 2024. In fact, FM Nirmala Sitaraman announced to hike loan amount under PMMY during union budget 2024-25 in July. Tarun Plus Mudra Yojana is the result of this announcement. Tarun + Mudra Scheme will help to entrepreneurs in their growth and expansion of any type of business like manufacturing, service etc.

Tarun + Mudra Loan Amount

Till now any individual entrepreneur will avail loan of up to Rs 10 lakh under Pradhan Mantri Mudra Yojana (PMMY) but by introducing Tarun Plus category now any eligible entrepreneur will avail business loan benefits up to Rs 20 Lakhs.

Components of PM Mudra Yojana – Revised

There are four components under Mudra (Micro Units Development & Refinance Agency Ltd.) Yojana. That all are listed below.

- Shishu Mudra Loan (Loan up to Rs 50,000)

- Kishor Mudra Loan (Loan range Rs 50,000 to Rs 5 Lakh)

- Tarun Mudra Loan (Loan range Rs 5 Lakh to 10 Lakh)

- Tarun Plus Mudra Loan (Loan range Rs 10 Lakh to 20 Lakh)

Eligibility Conditions

By the same criteria applies here which is for other 3 components. Although let’s discuss.

- All Indian citizens can apply Mudra Loan whose age is more than 18 years and want to start a new or expand their business.

- Applicant should not defaulter in previous in any bank in the country.

- Applicant must have a business plan to avail the loan.

- Only non-farm income generating activities like manufacturing business, processing business, service sector or trading business eligible.

- Tarun Plus loan only sanctioned to those who already repay regular their Tarun loan amount up to Rs 10 lakh is eligible to avail Rs 20 lakh Mudra Loan.

- Applicant apply for a Mudra loan to any of these Member Lending Institutions (MLIs)

- Private Sector Banks

- PSU Banks

- Regional Rural Banks (RRBs)

- Small Finance Banks

- Foreign Banks

- Micro Finance Institutions

- Non-Banking Finance Companies (NBFCs)

Cautions: “There are no agents or middleman engaged by MUDRA for availing Mudra Loans. The borrowers are advised to keep away from persons posing as Agents or Facilitators of PMMY”

Necessary documents for application

- Aadhaar Card

- Business Documents

- Address Proof

- Bank Statement

- Income tax return

- Trade Reference

- PMMY Application Form

Tarun Plus Mudra – Interest rate

There are not pre decided about the Mudra Loan interest rate. But you don’t need to pay highest rate of interest. Afterall it’s totally depends on where you can apply for the mudra loan means which banks or NBFC.

Tenure – Loan repayment period

Again loan repayment period (Tenure) is also depending on the banks where you apply for the business Mudra loan.

Tarun Plus Mudra Loan 2025 Apply Online

By following these steps you can apply for Tarun Plus Mudra loan.

Step 1: Visit Mudra.org.in official website.

Step 2: On the home page, scroll down and find the components of the scheme.

Step 3: Once infront of your eyes, click on the Tarun Plus.

Step 4: Now a new page will open where you can download the Tarun Plus Mudra loan application form in pdf format.

Step 5: Print it out and fill all the required details and attach all the necessary documents.

Step 6: Now visit the bank where you want to avail Mudra loan and submit there.

Step 7: Remaining steps will be instructed by the bank follow them with focusing.

Step 8: Once application completed, you will be sanctioned with loan amount.

Also Read: How to apply for HDFC Kishor Loan?

Key Highlights

| Tarun Plus | Details |

|---|---|

| Scheme Name | PM MUDRA Yojana |

| Article | Tarun Plus Mudra Loan Apply |

| Introduced | 24th October, 2024 |

| Loan Amount | 20 Lakh |

| Beneficiary | Who already availed Tarun Loan under Mudra |

| Objective | Fostering robust entrepreneurial ecosystem |

| Official Website | https://mudra.org.in/ |

| Toll Free Number | 1800-180-1111 or 1800-11-0001 |

Also Read: How to finance for your solar system?

Helping benefits & Features

- Collateral free micro credit:- If you want to avail Mudra loan then there are no need to any collateral security.

- Easy to apply for business loan:- As we discussed earlier, very easy process to apply for the Mudra Yojana. Just download the application form, fill up and submit to the bank.

- Creating entrepreneurial ecosystem:- Till now millions of rupees sanctioned under the scheme and lakhs of beneficiaries will avail scheme benefits that will create easy to do business environment in the country.

- Multiple sources of funding:- There are seven types of funding institutions like banks, PSUs, Small finance banks, NBFCs etc.

- Direct connection of loan providers and borrowers:- There are no need of any middleman to avail loan for your business. As per the strict guidelines of the official website of any person posing as agents then he/she totally wrong.

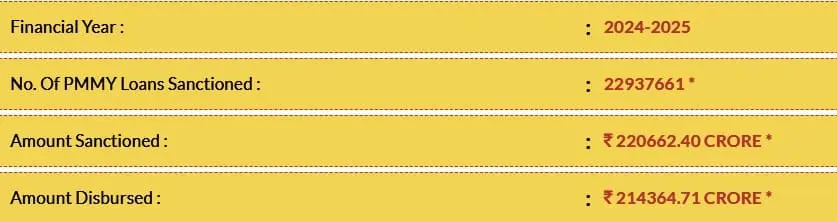

Latest Statics – Loan Sanctioned under PMMY

As per the end of October data on the official website, total loan sanctioned amount is ₹220662.40 crore from that ₹214364.71 crore disbursed already in 2024-25. While till from the scheme launched, total of 43 crores loan which amounting to Rs 22.5 lakh crore has been sanctioned as per the business today.

Frequently asked questions

How much loan will be provided under Tarun Plus Mudra Yojana?

Loan amount ranging from Rs 10 lakh to Rs 20 lakh

When Tarun Plus Mudra Yojana launched?

24th October, 2024

Which banks will provide Tarun Plus loans?

Almost all private as well as Public sector banks

Footnotes

Friends, we hope you got full details of Tarun Plus Mudra Loan details through this article. If this information was helpful to you then please share it to others and help them to grow as well. For more scheme details you can visit or bookmark web address; pmsuryaghar.in here.