The Bima Sakhi Yojana is a groundbreaking initiative by the Indian government aimed at empowering rural women through employment opportunities in the insurance sector. This program aligns with national goals to advance gender equality and enhance women’s economic independence while fostering financial inclusion and entrepreneurship.

By equipping women with skills and resources to thrive in the insurance industry, the initiative creates sustainable livelihoods and strengthens their role in financial services. Through this LIC’s Bima Sakhi Yojana, women can also earn monthly stipend ranges between Rs 5000 to Rs 7000 per month.

Headings

- 1 About Bima Sakhi Yojana in English 2025

- 1.1 Core Objectives

- 1.2 Overview of Bima Sakhi Yojana

- 1.3 Benefits of the Bima Sakhi Salary Yojana

- 1.4 Bima Sakhi Eligibility Criteria

- 1.5 Documents required for Online Apply

- 1.6 Key Features of the Scheme

- 1.7 Bima Sakhi Yojana Apply Online 2025

- 1.8 Expected Impact

- 1.9 Challenges and Considerations

- 1.10 FAQs

- 1.11 Conclusion

About Bima Sakhi Yojana in English 2025

The Bima Sakhi Yojana is set to launch on December 9, 2024, by Prime Minister Narendra Modi, starting from the state of Haryana. After its initial rollout in Haryana, the scheme will gradually be expanded to other states, eventually covering the entire country. Under this initiative, women will receive financial support ranging from ₹7,000 per month for the first year and so on along with various commissions and rewards.

As part of the Bima Sakhi Yojana, women will be trained and employed as insurance agents. They will be directly recruited by the Life Insurance Corporation of India (LIC). Once recruited, their role will involve promoting and enrolling people in insurance policies within their communities. The more insurance policies a woman facilitates, the higher her commission earnings will be. This program aims to empower rural women, enabling them to achieve economic independence and self-reliance.

Core Objectives

- Financial Independence: Equip rural women with tools and opportunities to achieve financial self-reliance through participation in insurance services.

- Self-Employment Opportunities: Encourage women to take on roles as insurance agents, promoting entrepreneurship and self-sufficiency.

- Community Development: Boost women’s economic engagement in underserved regions, contributing to broader local and national development.

Under Bima Sakhi Yojana, 2 lakh women will be provided employment opportunities. 10th pass women will be given training as well as financial assistance for 3 years.#BimaSakhiYojana #PMModiInHaryana pic.twitter.com/fo6Dg0Qx6Q

— MyGovIndia (@mygovindia) December 9, 2024

Overview of Bima Sakhi Yojana

| Aspect | Details |

| Objective | Empower rural women through financial inclusion and self-employment. |

| Target Beneficiaries | Women residing in rural or semi-urban areas of India. |

| Eligibility Criteria | – Indian citizenship- Minimum 10th grade education- Essential documents: Aadhar, PAN, bank details, etc. |

| Training and Certification | Professional training and certification provided by the Life Insurance Corporation (LIC). |

| Financial Benefits | – ₹7,000 monthly stipend in Year 1 – ₹6,000 in Year 2 – ₹5,000 in Year 3 – Additional commission-based earnings. |

| Support Infrastructure | – Digital platform for commission tracking and updates- Regular workshops for skill enhancement. |

| Implementation Scale | Engages 35,000 women nationwide; pilot project launched in Panipat, Haryana. |

| Application Process | – Online registration on LIC or government portal- Form submission with necessary documents- Approval and dashboard activation. |

| Expected Impact | – Financial independence for women- Boost to rural economies- Advancement of gender equality. |

| Training Period | 3 Years |

| Challenges | – Raising awareness about the scheme- Timely salary and commission disbursal- Long-term sustainability of support systems. |

| Official Website | https://licindia.in/test2 |

| Helpline Number | Launched Soon |

Benefits of the Bima Sakhi Salary Yojana

- In the first year, women will receive a monthly financial aid of ₹7,000.

- In the second year, this amount will be reduced to ₹6,000 per month. (subject to at least 65% of Policies completed in the First stipendiary year are in-force as at the end of the corresponding month of the second stipendiary year)

- By the third year, participants will receive ₹5,000 per month. (subject to at least 65% of Policies completed in the Second stipendiary year are in-force as at the end of the corresponding month of the third stipendiary year)

- Additionally, a bonus of ₹2,100 will be awarded as an incentive.

- Women achieving their insurance targets will be eligible for extra benefits and rewards.

This initiative is designed to provide women with sustainable employment opportunities while improving their financial stability and overall quality of life. It also seeks to foster entrepreneurship and enhance women’s participation in the financial sector.

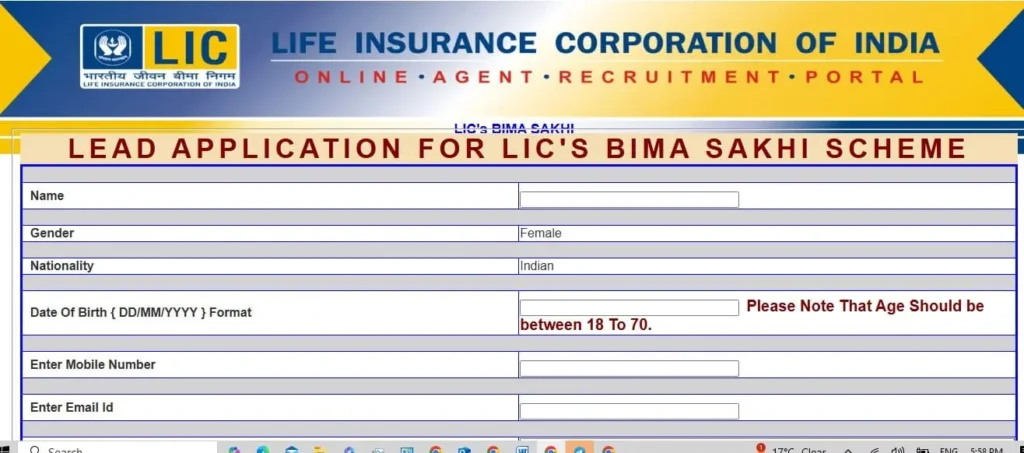

Bima Sakhi Eligibility Criteria

To participate in the Bima Sakhi salary, applicants must meet the following requirements:

- Nationality: Must be an Indian citizen.

- Educational Qualification: Completion of at least 10th or 12th grade.

- Residency: Must reside in rural or semi-urban areas.

- Age Criteria: Women age is between 18 to 70 years are eligible.

Note: Those family members already working as a LIC Bima Agent then their women family members are ineligible for the scheme. As well as those family member who are working as a government employee also ineligible for the scheme.

Documents required for Online Apply

When you visit official website then you need to upload various documents for Bima Sakhi Yojana Apply Online. Kindly consider these documents listed below.

- Aadhaar Card

- Age Certificate

- 10th Class Marksheet

- Mobile Number

- Email ID

Key Features of the Scheme

- Specialized Training and Certification:

- Participants receive professional training through the Life Insurance Corporation (LIC) to prepare them as insurance agents, known as “Bima Sakhis.”

- Certification is granted upon successful completion of the program.

- Financial Benefits:

- Participants earn a fixed monthly stipend: ₹7,000 in the first year, ₹6,000 in the second year, and ₹5,000 in the third year.

- Additional earnings are generated through commissions on insurance policies sold.

- Support Infrastructure:

- A dedicated digital platform facilitates easy monitoring of commissions and policy updates.

- Regular workshops are organized to enhance participants’ skills and knowledge.

- Widespread Implementation:

- The initial rollout targets engaging 35,000 women across India.

- The scheme’s pilot phase was launched in Panipat, Haryana, a region known for its commitment to women’s empowerment.

Bima Sakhi Yojana Apply Online 2025

Follow the below steps to avail benefits of PM Bima Sakhi Scheme.

Step 1: Visit Official website of LIC here; https://licindia.in/test2

Step 2: Now home page of the official portal will open on your device.

Step 3: Where you can read the details of the scheme as well you can see the link which look like “Click Here for Bima Sakhi”.

Step 4: You just have to click on it and Bima Sakhi Yojana Application form will displayed on your device.

Step 5: You have to fill up all the necessary details like Name, Address, Age, Education, Mobile Number, Email ID Etc.

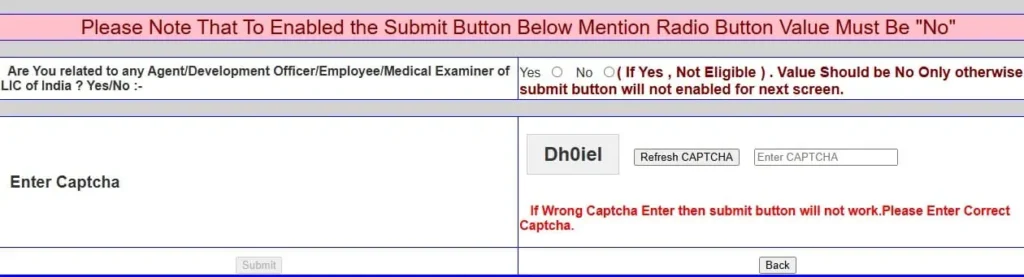

Step 6: After that if you want to give reference of any development officer, LIC agent or any other LIC’s employees then fill their details.

NOTE: If you check as a YES then you will ineligible for the scheme.

Step 7: Now, you have to enter your city name or district name as well.

Step 8: At the end, fill the Captcha code and hit the Submit Button.

NOTE: Approval and Activation

Applications are reviewed by LIC.

Once approved, participants receive access to a personalized dashboard for tracking progress.

Expected Impact

- Economic Growth: By integrating women into the financial system, the scheme is expected to significantly contribute to rural economic development.

- Gender Equality: The program supports the government’s broader agenda of empowering women, complementing initiatives like Beti Bachao, Beti Padhao.

- Women’s Empowerment: Providing stable income opportunities and career paths can uplift women, particularly those from economically disadvantaged backgrounds.

Challenges and Considerations

- Awareness Campaigns: Ensuring eligible women are aware of the scheme through effective outreach strategies.

- Efficient Implementation: Timely disbursal of stipends and commissions is critical for the program’s success.

- Long-Term Sustainability: Building a strong support system to sustain and expand women’s roles in the insurance sector.

FAQs

- What is the Bima Sakhi Yojana?

The Bima Sakhi Yojana is a government initiative to empower rural women by providing them opportunities to work as insurance agents. - Who can apply for the scheme?

Women who are Indian citizens, residents of rural or semi-urban areas, and have completed at least 10th grade can apply. - What financial benefits do participants receive?

Participants receive a fixed monthly stipend and additional income through commissions on insurance policies sold. - How are candidates trained for the program?

The Life Insurance Corporation (LIC) provides professional training and certification to prepare women for their roles as insurance agents. - Where can eligible women register for the scheme?

Women can apply through the official LIC website here https://licindia.in/test2

Conclusion

The Bima Sakhi Yojana represents a significant step towards empowering rural women by integrating them into the formal financial system. By offering training, financial incentives, and sustainable career opportunities, this initiative not only provides livelihood options but also strengthens the economic fabric of rural communities. Its success will depend on effective implementation, robust support systems, and the collaboration of stakeholders. You can regularly visit https://pmsuryaghar.in/ for more govt schemes.